Between rent payments, constant coffee or caffeine runs, nights out, and even just general socialising, your student loan might run out faster than you think! Learning to budget and budget effectively (yes, there is a difference!) is an essential skill, whether you’re in your first term or final year. It’s also an important skill that you will continue to use post-graduation and can make things a lot less stressful and a whole lot more enjoyable! Also, remember that a good budget doesn’t mean you have to give up all the fun things, but stretch your money so that you can afford both necessities and fun!

Understand where your money actually goes

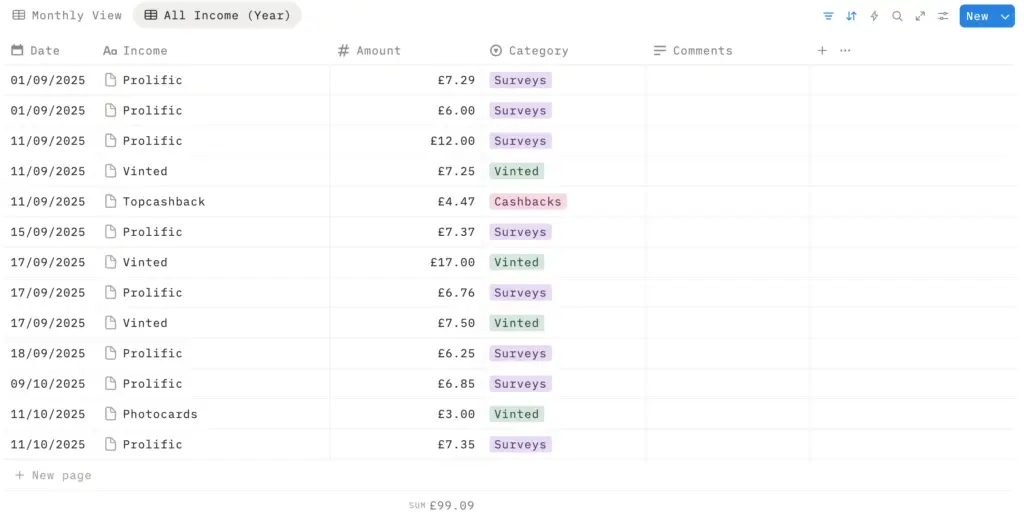

Before you can start to set out your monthly budgets, you need to understand where your money is coming from and where it is also going. Start by noting down all income sources, such as:

- Student Loan Instalments

- Any part-time job wages

- Any parental help or bursaries

- Any scholarships or grants

- Any side hustle incomes (Vinted, surveys, cashback payouts, etc.)

- Any other one-time forms of income

Next, note down all your expenses you can think of, both the essentials and your wants:

- Rent and utilities

- Any applicable council tax

- Groceries

- Travel

- Streaming subscriptions

- Socialising and nights out

- Cheeky takeaways

To ensure that you don’t overlook any expenses, it’s highly recommended to review your bank statements monthly. This can also help protect you against fraud and question any transactions that you might not recognise. Even better, this habit can help you to identify what your spending patterns are like and where a lot of your money might be going. For example, you might realise that a subscription service has recently increased in price, or the daily coffees you have been purchasing cost more than you thought.

Set realistic spending goals

Okay! Now that you know where your money is coming from and where it’s going, it’s time to make sure that every penny is carefully thought about. When it comes to budgeting, you may have heard of the 50/30/20 rule, or for those who haven’t:

- 50% of your income should go towards needs (rent, bills, groceries, travel)

- 30% of your income should go towards wants (social life, clothes, takeaways)

- 20% of your income should go towards saving

However! It’s typical for a student’s needs to take more than 50% of their annual income, especially in expensive cities like London. If this is the case, you may choose to adjust the formula to better suit your needs, for example 60% in needs, 25% for wants, and 15% for savings. Don’t feel guilty for needing to juggle the formula around from its original form. The key is to make budgeting as realistic as possible, so you’ll stick to your spending restrictions! With this being said, it is also a good reminder not to feel guilty if you need to change how you budget each month, as this method isn’t one size fits all or set in stone.

Choosing the right tools to help you budget

With so many apps out there, it can easily become a daunting task trying to start budgeting, but don’t be swayed! You don’t really need anything fancy. I would honestly recommend sticking to a simpler app or method to ensure you don’t feel overwhelmed and remain consistent. Some popular budgeting apps include:

- Monzo or Revolut: You can set spending limits, and each month you can see where your money goes.

- Google Sheets

- Notion

Student banks also tend to offer interest-free overdrafts, tastecards, railcards, and more benefits. Although these benefits sound quite lucrative, be careful not to fall into the trap of relying on your overdraft to manage payments. At the end of the day, it is still considered debt even if it’s interest-free!

Consider where you can cut some costs…

When learning to budget, there will most definitely be times when you are required to reduce areas of spending. However, this isn’t always about removing certain aspects for good! It’s about being strategic with your spending and managing your finances better so that your money can stretch further. There are also some pretty common ways to reduce spending in certain categories:

1. Food and groceries

Learning to meal prep will become essential to cutting down costs. If you prepare your meals ahead for the week, you can easily purchase the necessary ingredients in bulk, potentially saving an upwards of £20-30 a week! Rather than reaching for the pricier branded items, consider switching to a supermarket’s own brand or discount stores such as Lidl, Aldi, Farmfoods, The Company Shop, and others. This way, you’ll be able to bulk-batch pastas and curries and freeze portions for the days when you are too busy to cook. To go one step further, you could also consider apps such as Too Good To Go and Olio for highly discounted or free food.

2. Transport

The biggest way to save on transport will be acquiring a 16-25 Railcard or student bus passes. They typically pay for themselves very quickly and are very worthwhile to have! For railcards, it is often cheaper to purchase 3 years in one go, and you can even look for 25% off with student discounts on Trainpal, as well as another 20% cashback on Topcashback. Of course, if you live near campus, walking or cycling can save lots of money as well!

3. Books and supplies

Unless absolutely necessary, it is always advised to never buy textbooks brand new. It’s not common for classes in the UK to require physical textbooks; however, there are plenty of resources to overcome spending an outrageous amount. For example, you could rent the textbooks needed from the library for a short period of time to take your notes (which is also a motivating factor to get them done before the return period). Additionally, other areas such as second-hand shops near the campus, or websites like Vinted, Facebook Marketplace, eBay, and more. You could also consider sharing your textbooks with a classmate if needed and halve the costs to save further!

4. Social Life

Plan which days you choose to go out in the semester, and try to avoid the busiest times, as these are often the most expensive. Look for businesses that offer student night deals, free events, free drinks or meals, or even free cinema tickets.

Build a safety net

Arguably, one of the more important parts of budgeting is ensuring you are continuously building up a savings pot. Even small savings can make a significant difference over a long period, and adopting this practice is a good idea. Having an emergency fund is crucial for when unexpected emergencies occur and you need the funds to cover them. Try keeping your savings in a different account or app so that you aren’t tempted to use them if you go over your expected budget.

There are a multitude of ways that you could set aside money, such as following the 20% rule, putting aside a set amount each month, i.e, £10, £20, or even rounding transactions. Let’s say that you spend £2.50 on a transaction, you can round up by 50p and put that into a savings account.

Review and adjust regularly

Remember that circumstances can quickly change whilst you are a student, expenses might go up, or income might go down. Therefore, it is a good idea to check in at the end of every month or term to see what worked for you or didn’t. You might have spent more than expected in some areas or less, and you could adjust your budget accordingly. It’s also very easy to go over your budget sometimes, which is all the more reason to adjust your budget. Don’t let this become discouraging, and abandon the plan. It’s all about making progress and finding a system that works for you! Even small changes can have a big and lasting impact over time, and if you start budgeting now, you can stress less in the future and save more. So good luck, and I hope that this guide helps you to understand budgeting a little bit more! If you’re looking for more money help, why not check out this article on ways to save?

Authors

-

Hi, I'm Tori! I'm a recent graduate from UWE Bristol, where I previously studied Business & Management for 3 years. I'm currently seeking employment in the realm of finance, but whilst that is in the works, I'm now sharing all my knowledge I gained through university and passing it on to all of you reading this. Thanks for checking my articles out! I hope that my tips and tricks help you prepare or get through university slightly easier.

View all posts

-

Aminah is a dedicated content expert and writer at Unifresher, bringing a unique blend of creativity and precision to her work. Her passion for crafting engaging content is complemented by a love for travelling, cooking, and exploring languages. With years spent living in cultural hubs like Barcelona, Sicily, and Rome, Aminah has gained a wealth of experiences that enrich her perspective. Now based back in her hometown of Manchester, she continues to immerse herself in the city's vibrant atmosphere. An enthusiastic Manchester United supporter, Aminah also enjoys delving into psychology and true crime in her spare time.

View all posts